Extra Credit

School may be out for summer, but you can still earn

high marks for good credit.

| Q | How is my credit score calculated? |

| A |

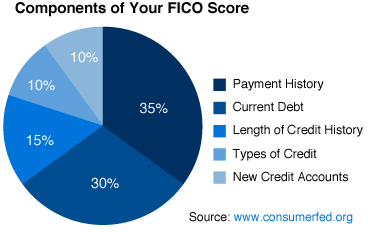

Fair Isaac Corporation, a credit analytics company, created the FICO score. Many lenders use FICO scores to assess consumers' creditworthiness. To calculate your score, FICO evaluates five components of your credit report: FICO scores range from 300 to 850; most people score in the 600s and 700s. |

| Q |

|

|

| A | Paying your bills on time—or not—has the |

|

| Q |

|

|

| A | Many credit counselors suggest that you use only 10% to 30% of the credit available to you, as lenders like to see that you don't need to buy everything on credit. Maxing out your credit cards will tend to lower your score, while paying down your credit-card debt will tend to improve it. |

| Q | I'm not planning to apply for new credit anytime soon. Why should I care about my credit score? |

| A | Credit scores are relevant in more than just new-credit applications. Having a high score can make it easier to negotiate lower interest rates with current creditors and help you qualify to refinance your mortgage. |

© 2013 Dow Jones & Company, Inc. Prepared by Dow Jones Content Lab, a service of Dow Jones & Company Inc.

All Rights Reserved.

Transamerica Retirement Solutions is prohibited by law from providing tax or legal advice outside the company. The information contained in this article is intended solely to provide general summary information and is not intended to serve as legal or tax advice applicable to certain matters or situations. For legal or tax advice concerning your situation, please consult your attorney or professional tax advisor. Although care has been taken in preparing this material and presenting it accurately, Transamerica Retirement Solutions disclaims any express or implied warranty as to the accuracy of any material contained herein and any liability with respect to it.

FEATURE

What Type of Investor are You?

Whether retirement is a few months or many years away, there are steps you can take while you're still working to create a secure financial future for yourself and your family.

FAST FACTS

Retirement Readiness Trends

Feeling a little anxious about your future financial security? You're not alone.

Connect with us: