Global Diversification in Investing

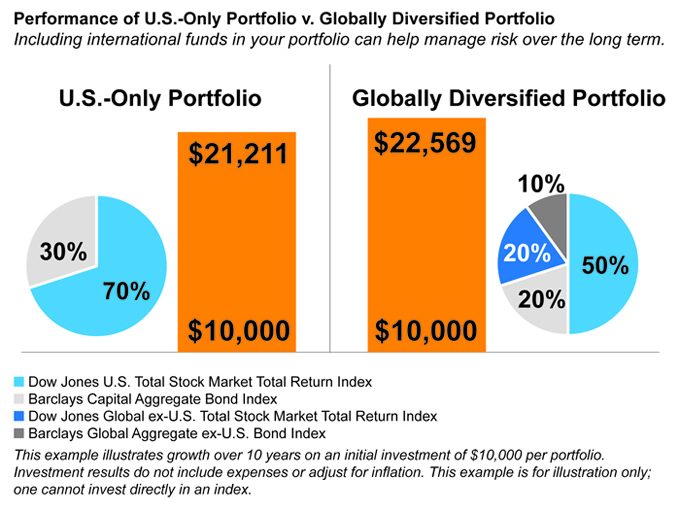

There's no single reason why people avoid non-U.S. investments. Some are concerned about economic instability abroad; others are unwilling to invest in unfamiliar companies and governments. But maintaining a globally diversified portfolio can actually help manage risk over the long term.

| Q | How do international stock and bond funds differ from domestic stock and bond funds? |

| A | International stock funds invest in non-U.S. companies, and domestic stock funds invest in U.S. companies. As you might assume, international bond funds invest in fixed income securities issued by foreign companies and governments. (For their part, "global" funds do a bit of both.) Some international funds limit their holdings to specific geographical regions—such as Europe or Asia—while others invest more broadly, selecting from the entire universe of stocks and bonds issued by companies and governments outside the U.S. Before investing in an international fund, make sure you understand its investment objective; risk and return potential can vary significantly according to the country or region in which the fund invests. |

| Q |

|

|

| A | Including international funds in your portfolio can help manage risk over the long term. Many of the world's companies are based outside the U.S., economic changes affect every market slightly differently, and countries outside the U.S. have products and natural resources that can't be found—or invested in—domestically. |

| Q | What are the risks of a globally diversified portfolio? |

| A | A globally diversified portfolio carries risks that are unique to non-U.S. markets, such as fluctuations in currency values and political uncertainties. These risks can be magnified in developing countries, also known as emerging markets, where markets are less regulated and economies are less established. Even so, many international funds invest in a wide variety of geographies, sectors, and currencies to reduce the chances that instability in a single country will negatively affect the performance of the entire fund. |

© 2013 Dow Jones & Company, Inc. Prepared by Dow Jones Content Lab, a service of Dow Jones & Company Inc. All Rights Reserved.

Transamerica Retirement Solutions is prohibited by law from providing tax or legal advice outside the company. The information contained in this article is intended solely to provide general summary information and is not intended to serve as legal or tax advice applicable to certain matters or situations. For legal or tax advice concerning your situation, please consult your attorney or professional tax advisor. Although care has been taken in preparing this material and presenting it accurately, Transamerica Retirement Solutions disclaims any express or implied warranty as to the accuracy of any material contained herein and any liability with respect to it.

FEATURE

Americans' Retirement Readiness

Most Americans' retirement income will come primarily from personal savings. Get an idea of whether you're saving enough, and what you can do about it if you're not.

Connect with us: