FEATURE

Spend Wisely,

Save Wisely

One of the biggest reasons why New Year’s resolutions fall by the wayside is that the goals we set for ourselves are overwhelming: “lose 25 pounds” instead of “eat better,” “learn to speak Italian” instead of “take an Italian class.”

If you’ve resolved to improve your personal financial situation in 2014, set yourself up for success by establishing manageable, measureable goals.

Following these steps can help you get started.

STEP 1: Create a Budget

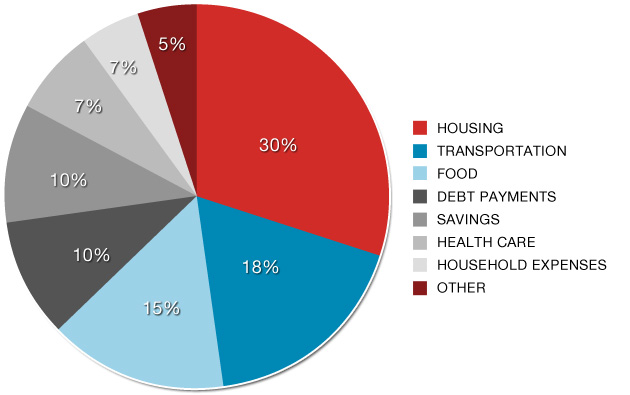

The budget allocations of take-home pay illustrated in the pie chart below are based on a combination of household expense data collected by the U.S. Bureau of Labor Statistics and the recommendations of experienced financial professionals. Use these allocations as a starting point for developing your 2014 budget. If you find that your current spending patterns are significantly different from the recommended percentages—for example, you’re spending 25% on transportation but only 5% on debt payments—consider making some changes.

Source: http://www.bls.gov/news.release

STEP 2: Look for Opportunities to Cut Expenses

As the chart above illustrates, 10% of a typical budget is allocated to savings—ideally 5% to an employer-sponsored retirement plan and 5% to an emergency fund. Saving 10% of your income may sound like an unrealistic goal, but you can probably make it happen with a few adjustments to your spending habits. For example:

| Change | Calculation | Annual Savings |

| Shorten your annual vacation from two weeks to 10 days | 4 nights in hotel x $100 per night = $400 per trip | $400 |

| Bring your lunch to work two days a week instead of eating out | 2 days x $10 per day = $20 per week $20 per week x 50 weeks = $1,000 per year | $1,000 |

| Go out to dinner twice a month instead of once a week | 2 meals x $25 per meal = $50 per month $50 per month x 12 months = $600 per year | $600 |

| Cancel premium cable channels | 2 channels x $20 per channel = $40 per month $40 per month x 12 months = $480 | $480 |

| Cancel subscriptions to newspapers or magazines that you can read for free online | 1 newspaper x $15 per month x 12 months = $180 per year | $180 |

| Attend free events instead of paying for entertainment | 2 concerts per year x $50 per ticket = $100 per year | $100 |

| Total | $2,760 |

STEP 3: Start Saving

Once you find ways to cut your expenses, visit Transamerica Retirement Solutions to adjust your contributions to your employer-sponsored retirement plan account, and contact your bank or credit union to learn about the savings account options available to you.

Every Penny Counts

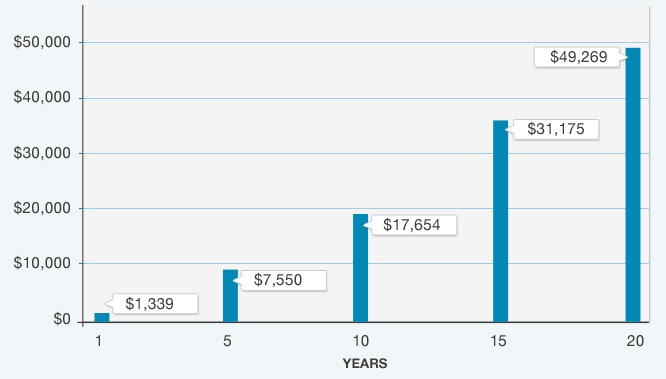

It may not seem like much, but saving $25 a week adds up over time.

In the example below, investing just $25 per week over 20 years, earning an average return of 6% per year will result in almost $50,000.

This example is for illustrative purposes only.

▶ |

Use the Loose Change Calculator to see how the few dollars you spend here and there can add up by the time you retire. |

FAST FACTS

Reality Check on Social Security

If retirement is more than 20 years away for you, it may be funded more by personal savings than Social Security.

ASK THE EXPERTS

Should I pay off a mortgage or save more for retirement?

Find out what you need to consider before making this decision.

VIDEO

Why Do Investors Take a Chance?

This video explains the fairly complex answer to this surprisingly simple question.

Connect with us: